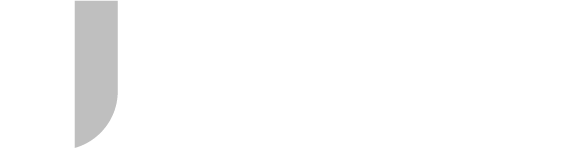

In 2024, multinational cement corporations experienced significant divergence in performance. While European and North American companies focused on optimizing profitability, India and Sub-Saharan Africa emerged with robust revenue growth. The rise of domestic producers such as UltraTech Cement and Adani Cement is challenging major corporations, amid the industry’s exposure to geopolitical factors and trade policies.

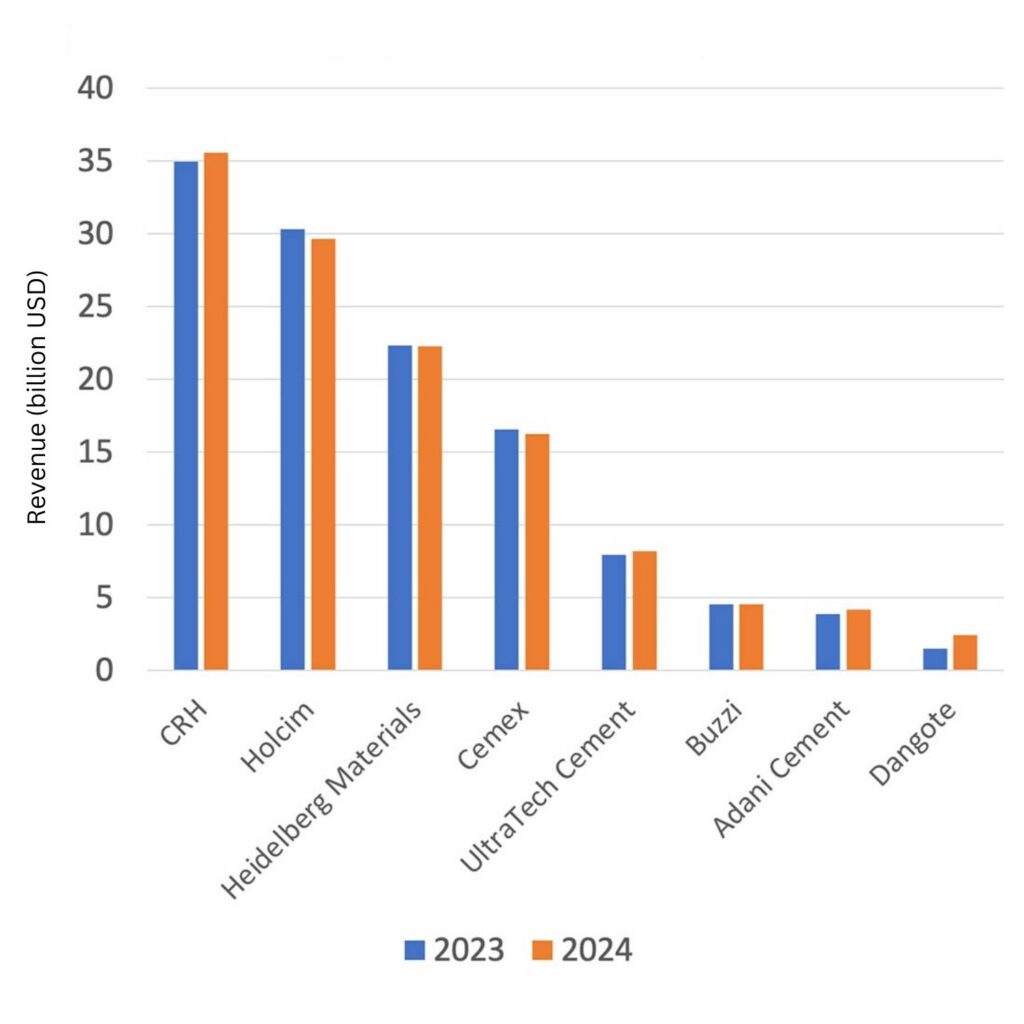

Cement manufacturers in North America and Europe recorded stable revenues and profit growth in 2024. India and Sub-Saharan Africa stood out as high-growth markets in terms of revenue. Notably, UltraTech Cement (India) surpassed Holcim in cement consumption. However, European cement corporations remained satisfied with their strong profit margins, with Holcim achieving a record financial performance in 2024 and Heidelberg Materials reporting a highly successful financial year.

Source: Company Reports. Note: Calculations for UltraTech Cement; consolidated data from Ambuja Cement used for Adani Cement.

Holcim experienced a slight decline in revenue compared to 2023, but its operating profit increased by 4%, reaching $1.31 billion. The company is also preparing to spin off its U.S. operations, establishing Amrize and listing it on the New York and Swiss stock exchanges. Although sales of cement, ready-mix concrete, and aggregates declined, Holcim’s Solutions & Products division grew, sustaining profitability.

Heidelberg Materials maintained stable revenues, while its recurring EBITDA (RCOBD) increased by 6% to $3.4 billion. North America delivered an impressive 19% profit growth, reaching $4.8 billion. The company continues to emphasize sustainability, with plans to launch evoZero carbon-neutral cement in 2025.

Source: Company Reports. Note: Annual sales volume data provided for CRH; calculations made for UltraTech Cement.

CRH posted strong results in the North American market. Revenue from its U.S. Building Materials division increased by 5% to $16.2 billion, while EBITDA rose 22% to $3.75 billion. This success was driven by pricing strategies, acquisitions, and cost optimization.

Cemex faced challenges, with both revenue and profits declining across its three key regions—Mexico, the U.S., and Europe-Middle East-Africa. In particular, its U.S. operations were impacted by four hurricanes and extreme cold in Texas. Nevertheless, Cemex improved profitability in Q4 2024 and launched a $350 million cost-cutting program over the next three years.

UltraTech Cement made a significant impact, becoming the second national cement producer (after Chinese firms) to surpass multinational corporations in production, consuming 120 million tons of cement in 2024. However, net profit declined by 19% due to weak pricing. Meanwhile, Adani Cement demonstrated strong growth in both revenue and profitability, aiming to become one of the world’s largest cement manufacturers outside China by 2030.

Dangote Cement (Nigeria) achieved remarkable growth, with revenue increasing by 62% to $2.39 billion and EBITDA rising 56% to $591 million, driven by the recovery of the domestic market. However, sales declined in certain African countries due to adverse weather conditions and political instability.

The U.S. market remains a key factor for multinational cement corporations, albeit with inherent risks. The U.S. government’s 25% tariff on imports from Canada and Mexico could impact the domestic cement industry. Meanwhile, emerging markets such as India and Sub-Saharan Africa are attracting growing attention, with strong potential for future growth.

Source: ximang.vn